Bankruptcy Services

We’re here to help.

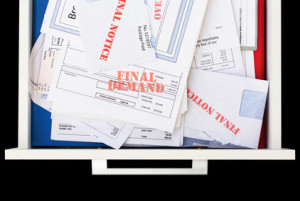

Experiencing overwhelming debt due to an unexpected loss of a job, medical issues, housing costs, or simply getting behind on credit cards?

Has it gotten to the point where you are getting harassing collection phone calls, foreclosure notices, judgment notices or even have a garnishment taking money from you each paycheck?

Caldwell Law is here to help you get control over the debt and potentially seek a debt free lifestyle.

Don’t go it alone. Trust in Our Experience.

Caldwell Law is one of the leading law firms in Nebraska in the field of Bankruptcy and Debtor’s Rights. As a Lincoln, Nebraska Bankruptcy Attorney and Omaha Debt Relief Lawyer, Caldwell Law has situated itself among the top firms in Nebraska.

Caldwell Law is a Congressionally designated Debt Relief Agency. We help people file for Bankruptcy under the Bankruptcy Code.

The authority to enact uniform federal bankruptcy laws is given to Congress by the U.S. Constitution. That is why bankruptcy court is within the United States Federal Court system.

Reason for Bankruptcy Laws in Nebraska

Bankruptcy laws allow individuals and entities the ability to discharge, or wipe away, some or all of their debt in order to start their lives over. Bankruptcy actually helps the economy by cleaning out, so to speak, the bad old debt that prevents a debtor, someone who owes money, from trying to improve their station in life and buy more stuff, thus stimulating the economy. Bankruptcy laws provide a financial safety net that encourages individuals to create small businesses and hire employees and make products people want to spend their money on. Without bankruptcy, lenders would spend more time and resources trying to collect on bad debt rather than stimulating the economy by lending to other individuals. Those other individuals would not have the ability to open an important business without the possibility of funds from lenders.

What types of Bankruptcy are available?

There are different types of bankruptcy. Each type is referred to as a chapter number, referencing the chapter number of that particular portion of the bankruptcy code. Click below for more information about each individual bankruptcy chapter:

• Chapter 7-Available to individuals and business entities. This type of bankruptcy is commonly called a “Liquidation” or “Straight” Bankruptcy.

• Chapter 11-Available to special individuals and businesses. This type of bankruptcy is called “Reorganization”.

• Chapter 12-Available to family farmers under certain circumstances. Allows the family farmer to continue farming operations while in bankruptcy.

• Chapter 13-Available to individuals only. This type of bankruptcy is commonly called a “Wage Earner’s Plan”.

If you are in substantial debt, having your wages garnished, being sued, have property about to be repossessed or foreclosed, contact Caldwell Law immediately to know where you stand with your creditors.